We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. A business usually shuts down due to a liquidity crisis rather than low or no generation of profits.

How to Calculate the Cash Coverage Ratio: A Step-by-Step Example

Similarly, the interest expense is also available in the income statement. Some of these figures may also be available in the notes to the financial statements. On top of that, some companies may have more obligations while others are lower.

- However, unlike the cash coverage ratio, the interest coverage ratio uses operating income, which includes depreciation and amortization expense, when calculating the ratio results.

- When a company’s interest coverage ratio is 1.5 or lower, it can only cover its obligations a maximum of one and one-half times.

- Include the company’s present obligations rather than its long-term liabilities.

- Instead of considering just one aspect of a year, it accounts for the entity’s past and future performance in terms of making debt payments.

Part 2: Your Current Nest Egg

While a ratio of more than one implies that the firm has the finances to pay its obligations, most businesses do not maintain a much greater than equal ratio. Most creditors utilize the cash coverage ratio to establish credit eligibility and financial standing. It gives customers a company’s capacity to pay off present financial obligations. Because certain creditors have particular conditions to qualify for a loan, this might assist brands in determining if they are suitable. This ratio determines the company’s position to pay off its entire debt from its earnings.

What is a good current cash debt coverage ratio?

The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience restaurant inventory guide for dummies purposes only and all users thereof should be guided accordingly. Finance Strategists has an advertising relationship with some of the companies included on this website.

A higher ratio means the company earns a good portion of its revenue and can efficiently pay off its liabilities and obligations. It is because its debt has increased over the years, and EBIT has gone down. It happened because of the margin pressure and the entry of Reliance Jio into the market. If this continues in the future, Bharti Airtel could be in a bad position. As a result of this, it has to sell off its assets to repay the loan.

Other Resources

It is in the same family as the metrics that include the current ratio and the quick ratio. However, it’s more restrictive because it measures only the available cash and cash equivalents, not other assets. Cash coverage ratio and times interest earned are two important metrics used to measure a company’s financial health. Both ratios provide insight into a company’s ability to pay its debts in the short term. It is an important indicator of a company’s liquidity, solvency, and overall financial health.

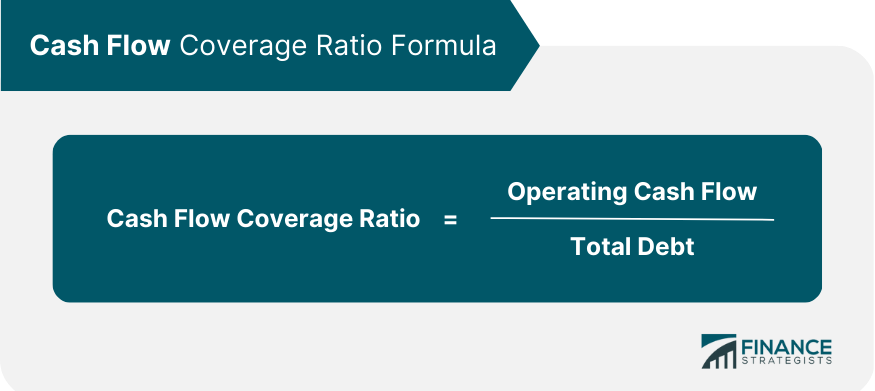

The cash coverage ratio is a simple comparison between cash and equivalents on hand to the interest expense. The interest coverage ratio, or times interest earned (TIE) ratio, shows how well a company can pay the interest on its debts. It is calculated by dividing EBIT, EBITDA, or EBIAT by a period’s interest expense. A balance sheet and income statement will typically include information on cash and cash equivalents. Depending on your company’s accounting methods, these numbers may display together or individually. Cash equivalents are assets or investments that may be converted to cash rapidly, generally in 90 days or less.

A poor interest coverage ratio, such as below one, means the company’s current earnings are insufficient to service its outstanding debt. An interest coverage ratio of 1.5 is one where lenders will likely refuse to lend the company more money, as the company’s risk for default may be perceived as high. If a company’s ratio is below one, it will likely need to spend some of its cash reserves to meet the difference or borrow more. The cash coverage ratio is essential for identifying a brand’s capacity to pay off its obligations and how soon it can do so.

Leave a Comment