This is important for internal and external stakeholders, as it indicates the company’s financial health. When it comes to assessing a company’s financial health, lenders often prefer to use the Liquidity Ratio over the Current Ratio, as they want to know how much cash or marketable securities are available for debt repayment in case of an emergency. Therefore, considering both ratios is essential to understand your company’s short-term solvency accurately.

Article 6 Composition of the Liquidity Buffer

Liquidity can be found on the balance sheet under “current assets,” which includes cash, cash equivalents, accounts receivable, and inventory. All of these items are easily convertible into cash within one year or less. To manage Liquidity Ratios, it’s essential to maintain an appropriate balance between current assets and liabilities. Companies are using different kinds of treasury software to manage their Liquidity Ratios and ensure that they are in a healthy financial position. It gives them a clear view of their liquidity ratio and helps them take corrective action if it is not within the desired range.

Great! The Financial Professional Will Get Back To You Soon.

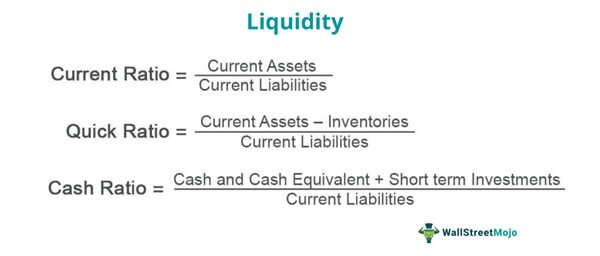

A higher current ratio indicates greater liquidity and a lower risk of financial distress. For most industries, a current ratio of at least 1.5 is considered financially healthy. Fundamentally, all liquidity ratios measure a firm’s ability to cover short-term obligations by dividing current assets by current liabilities (CL).

Browse more Topics under Accounting Ratios

Although this means that you could only cover a small part of your liabilities with the most liquid funds, companies accept this risk for growth reasons. If the cash ratio is very high, it means that a lot of cash is lying around unused and cannot be used for investments claiming dependent credit for a disabled spouse and growth. Therefore, the company’s liquidity risk reduced substantially based on the improvement across each liquidity ratio. Both types of ratios are essential for assessing different dimensions of a company’s financial performance and risk profile.

The total current liabilities for the year stood at ₹2,37,691 crore, reflecting an increase of 8.5% from fiscal year 2022. Should the need arise, does the firm have enough cash to cover its short-term obligations? Marketable securities are also included because they are as quick to liquidate as a bank deposit. An example of a Liquidity Ratio is the Current Ratio, which is calculated by dividing a company’s current assets by its current liabilities.

Absolute liquidity ratio or cash ratio

Accounts receivable reflects money owed to the company by customers for goods or services, which is expected to be paid within a short period of time. Finally, inventory includes finished goods, raw materials, and works-in-progress that the company intends to sell as part of normal business operations. Though not as liquid as cash, inventory typically is sold to generate cash relatively fast. Some assets counted towards the LCR include cash, central bank reserves, high-rated government securities, and corporate bonds. These assets are readily converted into cash in private markets to meet outflows. The LCR does not include equities or low-rated bonds, which face liquidity risks themselves.

- Low ratios signal that it doesn’t have sufficient funds to cover its obligations without raising external capital.

- The cash ratio is more useful when it’s compared with industry averages and competitor averages or when looking at changes in the same company over time.

- An analyst can make combinations between assets and liabilities depending on the industry under review, the business’s nature, and the analysis’s purpose.

- The basic liquidity ratio measures a company’s ability to meet its short-term obligations with its most liquid assets.

The average current ratio was found to be 2.69 indicating that the company was in good financial health and capable of paying off short-term financial debts that may occur. The timing of payments for sales and purchases affects short-term cash flow. A company wants to collect receivables from customers as soon as possible after a sale. However, suppliers prefer slower payment cycles to maintain their own liquidity. Public companies must find an optimal balance for receivables and payables cycles.

A higher number indicates that a company has more liquid assets to cover its short-term debt, while a lower number suggests its liquidity position may be jeopardized. Higher NWC/Revenue ratios mean that more current assets are locked up in the business, which reduces liquidity – e.g. the company is struggling to collect cash payments from customers that paid on credit or facing difficulty in selling off inventory. The current ratio includes all current assets that can be converted into cash within one year and all current liabilities with maturities within one year. For instance, a declining liquidity ratio may indicate deteriorating financial health or inefficient working capital management. However, it may also mean a company is trying to hold onto less cash and deploy capital more rapidly to achieve growth. Credit institutions shall assume a 100% outflow for loss of funding on asset-backed commercial papers, conduits, securities investment vehicles and other such financing facilities.

A higher SLR sucks out liquidity from the system as it forces banks to maintain a larger cash reserve. This means there are 0.33 active military members per square kilometer of land. A higher ratio indicates a greater military presence and defense capability relative to the size of the nation. The ideal Ratio depends on a country’s defense strategy and perceived security threats. Most analysts consider a ratio above 0.5 to provide a strong territorial defense capability.

Liquid coverage ratio is the proportion of high liquid assets that banks need to maintain short term debts or liabilities. Liquidity ratios measure a company’s ability to meet its short-term obligations using its assets. They are essential in financial analysis for assessing a company’s financial health, solvency, and creditworthiness.

Leave a Comment